Adjusting Entries: Types, Examples, and Financial Impact

Since a portion of the service wasprovided, a change to unearned revenue should occur. The companyneeds to correct this balance in the Unearned Revenue account. Adjusting entries, or adjusting journal entries (AJE), are made to update the accounts and bring them to their correct balances. The preparation of adjusting entries is an application of the accrual concept and the matching principle.

- If the company would like to continue to occupy the rental property, it will have to prepay again.

- Here is an example of the Prepaid Rent account balance at the end of October.

- The required adjusting entries depend on what types oftransactions the company has, but there are some common types ofadjusting entries.

- The remaining $11,000 in the Prepaid Rent account will appear on the balance sheet.

Depreciation

(Notice in the journal entry above that the debit account is “Equipment,” NOT “Equipment Expense”). Fixed assets are first recorded as assets that later are gradually “expensed off,” or claimed as a business expense, over time. The adjusting entry ensures that the amount of supplies used appears as a business expense on the income statement, not as an asset on the balance sheet.

Adjusting Entries: Types, Examples, and Financial Impact

All revenues received or all expenses paid in advance cannot be reported on the income statement for the current accounting period. They must be assigned to the relevant accounting periods and reported on the relevant income statements. Adjustment entries are crucial in ensuring that financial statements accurately reflect the financial position of a company. The five most common types of adjusting entries are prepaid expenses, depreciation, accrued expenses, accrued income, and unearned income. Each type ensures accurate records are being kept of transactions in real-time. In accrual-based accounting, journal entries are recorded when the transaction occurs—whether or not money has changed hands—in a general ledger (or general journal).

Achieve Financial Accuracy With Free Bank Reconciliation Template

However, since the revenue has not been earned yet, it needs to be deferred and properly accounted for in the appropriate accounting period. An adjusting entry is an entry that brings the balance of an account up to date. Adjusting entries are crucial to ensure the correct balance and correct preparing adjusting entries information in an account at the end of an accounting period. Generally, expenses are debited to a specific expense account and the normal balance of an expense account is a debit balance. This account is a non-operating or “other” expense for the cost of borrowed money or other credit.

This type of adjusting entry is used when cash has been received or paid, but the related revenue or expense has not yet been earned or incurred. For example, if a company receives payment in advance for a service to be provided over several months, the initial cash receipt is recorded as a liability (unearned revenue). As the service is performed, the liability is gradually reduced, and revenue is recognized.

Comprehensive Guide to Inventory Accounting

Here are the ledgers that relate to the purchase of supplies when the transaction above is posted. Supplies are relatively inexpensive operating items used to run your business. At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

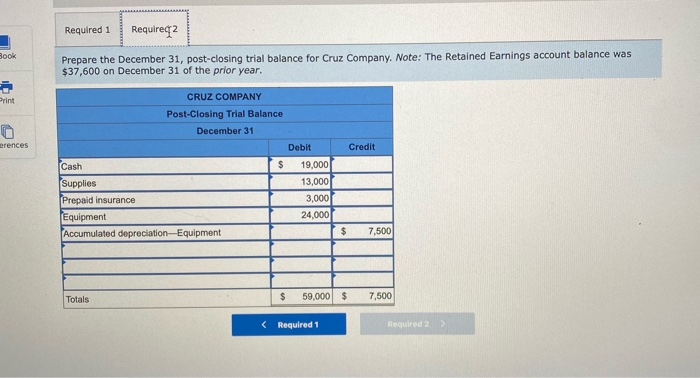

Click on the next link below to understand how an adjusted trial balance is prepared. A fixed asset is a tangible/physical item owned by a business that is relatively expensive and has a permanent or long life—more than one year. Its initial value, and the amount in the journal entry for the purchase, is what it costs. The $100 balance in the Supplies Expense account will appear on the income statement at the end of the month. The remaining $900 in the Supplies account will appear on the balance sheet.

Adjusting entries are made at the end of an accounting period after a trial balance is prepared to adjust the revenues and expenses for the period in which they occurred. This principle only applies to the accrual basis of accounting, however. If your business uses the cash basis method, there’s no need for adjusting entries. Prepaid expenses are things you’ve paid for upfront but haven’t yet used in full, and are considered company assets. Common examples of prepaid expenses include insurance policies, rent, and necessary supplies or materials.