4 2: Discuss the Adjustment Process and Illustrate Common Types of Adjusting Entries Business LibreTexts

These entries are posted into the general ledger in the same way as any other accounting journal entry. The purpose of adjusting entries is to show when money changed hands and to convert real-time entries to entries that reflect your accrual accounting. This category of adjusting entries is also known as unearned income, deferred revenue, or deferred income. Essentially, it refers to money you’ve been prepaid by a client before you’ve done the work or provided services. In the accrual system, this unearned income is seen as a liability and should be credited. Using the tableprovided, for each entry write down the income statement accountand balance sheet account used in the adjusting entry in theappropriate column.

Free Course: Understanding Financial Statements

Under the accrual basis of accounting, the matching is NOT based on the date that the expenses are paid. Not all journal entries recorded at the end of an accounting period are adjusting entries. For example, an entry to record a purchase of equipment on the last day of an accounting period is not an adjusting entry. The purpose of adjusting entries is to convert cash transactions into the accrual accounting method.

Introduction to Adjusting Journal Entries

Similarly, if a company has incurred an expense that has not yet been recognized, an adjustment entry is made to include this expense in the income statement. Adjusting entries are a crucial part of the accounting process and are usually made on the last day of an accounting period. They are made so that financial statements reflect the revenues earned and expenses incurred during the accounting period.

Accounting Services

The cash basis of accounting recognizes revenue and expenses when payment is received or made. Adjustment entries are not necessary under the cash basis of accounting, as all transactions are recorded when payment is made or received. Adjustment entries are an essential aspect of accounting that ensures financial statements are accurate and follow accounting principles. These entries are made at the end of an accounting period to adjust accounts and reflect any changes that have occurred during the period. Depreciation expense is the allocation of the cost of a long-term asset over its useful life. To record depreciation expense, an accountant would debit an expense account and credit an accumulated depreciation account.

Accrued revenues are revenues earned in aperiod but have yet to be recorded, and no money has beencollected. Some examples include interest, and services completedbut a bill has yet to be sent to the customer. Usually to rent a space, a company will need to pay rentat the beginning of the month. The company may also enter into alease agreement that requires several months, or years, of rent inadvance.

- Often, depreciation is recorded at the end of every year, until the estimated lifetime of the asset is complete.

- Situations such as these are why businesses need to make adjusting entries.

- At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- Students should carefully note that every adjustment has at least two effects due to double entry.

- When you make adjusting entries, you’re recording business transactions accurately in time.

What Are the Types of Adjusting Journal Entries?

The balance sheet is also referred to as the Statement of Financial Position. Interest Receivable increases (debit) for $1,250 because interest has not yet been paid. Interest Revenue increases (credit) for $1,250 because interest was earned in the three-month period but had been previously unrecorded. Interest can be earned from bank account holdings, notes receivable, and some accounts receivables (depending on the contract).

For the sake of balancing the books, you record that money coming out of revenue. Then, when you get paid in March, you move the money from accrued receivables to cash. No matter what type of accounting you use, if you have a bookkeeper, they’ll handle any and all adjusting entries for you. If you do your own accounting, preparing adjusting entries and you use the accrual system of accounting, you’ll need to make your own adjusting entries. To make an adjusting entry, you don’t literally go back and change a journal entry—there’s no eraser or delete key involved. In August, you record that money in accounts receivable—as income you’re expecting to receive.

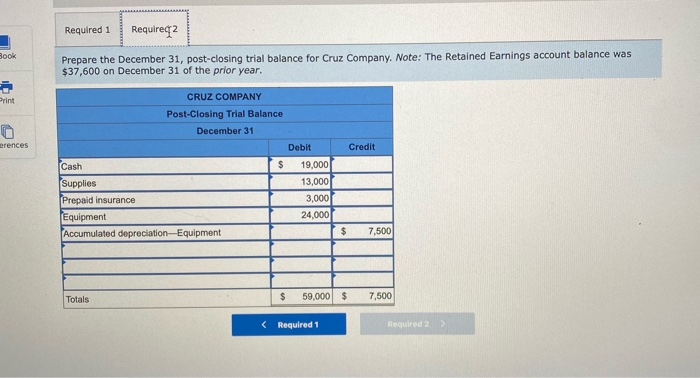

Once you’ve wrapped your head around accrued revenue, accrued expense adjustments are fairly straightforward. They account for expenses you generated in one period, but paid for later. The preparation of adjusting entries is the fifth step of the accounting cycle that starts after the preparation of the unadjusted trial balance. Since the Accumulated Depreciation account was credited in the adjusting entry rather than the Equipment account directly, the Equipment account balance remains at $6,000, its cost. The adjusting entry above is made at the end of each month for 60 months.